The results are in: Cebu Pacific has chosen Airbus for its historic fleet expansion, placing an order for up to 152 narrowbody aircraft.

On Tuesday, the low-cost carrier signed a memorandum of understanding with the European planemaker for up to 102 Airbus A321neo jets with an option for 50 more Airbus A320neo family aircraft.

This decision marks the largest aircraft order in Philippine history, but was it a difficult choice for the airline? Let’s examine the factors that likely led to Airbus securing this monumental deal.

Airbus all the way

Cebu Pacific has predominantly been an Airbus operator, exclusively on its narrowbody and widebody fleet. This has not been the case in its entire history since the airline flew Boeing 757s and McDonnell Douglas DC-9s in its infancy.

It was only in 2005 that the first Airbuses arrived for Cebu Pacific, and it let go of the 757s and the DC-9s in favor of the brand-new A319 and A320 planes. Back then, this revolutionized the carrier to what it is today, as it operated as an airline with one of the youngest fleets in Asia.

The philosophy at Cebu Pacific and other low-cost airlines is flying fresh and brand-new airplanes. Why? At face value, new planes may be much more expensive; newer planes mostly mean better technology and efficiency, which translates to lower operating costs in the long run. Older aircraft may also have increased maintenance requirements due to gradual wear and tear.

This means Cebu Pacific needs to place orders for brand-new aircraft to replace its aging fleet every few years. To recall, the last time that the Gokongwei-led airline placed a significant (at that time) order was at the 2019 Paris Airshow, where Airbus also won orders for 16 Airbus A330neo and 15 Airbus A320neo family aircraft.

A more capable aircraft

One of the main factors airlines consider when buying planes is its passenger & cargo capacity and range. Cebu Pacific has in-depth knowledge and first-hand experience with the capabilities of its Airbus A320neo family planes. Still, the specifications flaunted by the Boeing 737 MAX make it a serious contender.

When comparing the largest variants of the two families, the Airbus A321neo and the Boeing 737 MAX 10, the former beats out the latter in its maximum seating capacity for a single-class configuration at 244 vs. 230. That’s 14 more paying passengers for the airline.

However, we’ve seen Cebu Pacific configure its A321neos with 236 passengers, so there might be a small difference, after all. Still, there are more passengers than the maximum certified for the 737 MAX 10.

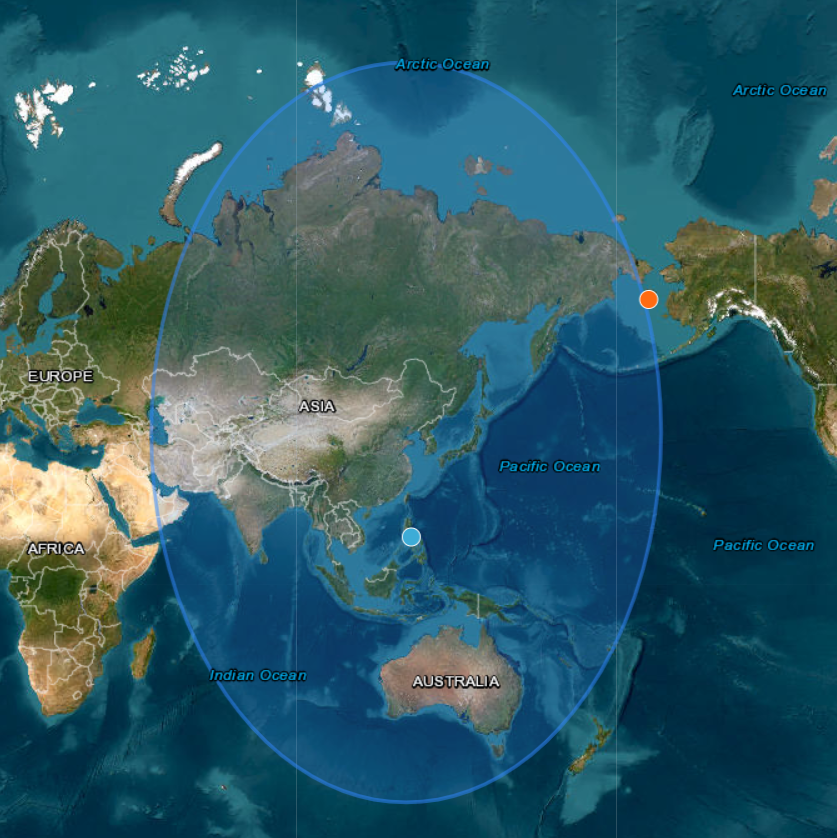

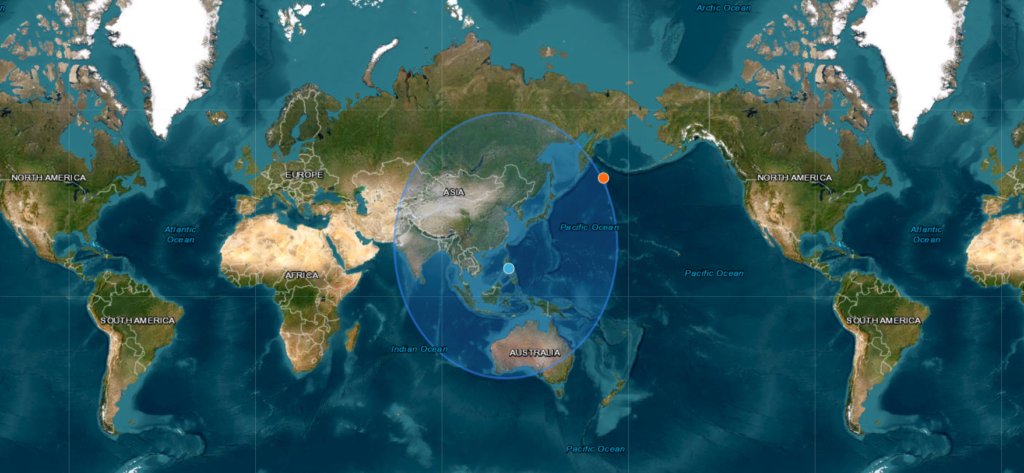

On the range aspect, the A321neo outperforms the 737 MAX 10 as it flies further by 900 nautical miles. However, weight remains the largest factor affecting range. Individually, both differ in reporting their respective ranges. Boeing claims to be able to fly the MAX 10 to 3,100 nm with a full cabin of 230 passengers. Meanwhile, Airbus reports the A321neo can fly 206 passengers in a typical dual-class configuration, up to 4,000 nm.

The Airbus A321XLR, an extra long-range variant of the A321neo, takes that range further to 4,600 nm. Cebu Pacific currently has ten on order.

Investments for the Airbus fleet

Cebu Pacific has heavily invested in ground equipment and facilities for its Airbus planes. One of the key differences between the 737 MAX and the A320neo is the latter’s ability to be loaded with containerized cargo called unit load devices (ULD).

ULDs make turnaround times faster than the commonly used baggage belt loaders that require staff to individually pick up and arrange luggage in the aircraft’s belly. With ULDs, the container itself can be loaded into the aircraft and can be unloaded at the destination. The containerized operations, however, would require specialized equipment, which the airline has been acquiring and strategically placing at its hubs.

In 2020, Cebu Pacific tapped specialist company Jettainer to operate its ULD operations across the low-cost carrier’s network. As part of the deal, Jettainer purchased the airline’s existing fleet of more than 2,700 ULDs, which it will efficiently manage depending on requirements and demand.

Since then, Cebu Pacific has aimed to containerize its operations to improve the efficiency of its network fully. If the carrier pushed through with the 737 MAX, this aspect would be a setback, given that the American aircraft can only be loaded with bulk cargo.

Years of Airbus experience

A big swing in favor of Airbus is the commonality with personnel, especially pilots, with the A320ceo and A320neo family aircraft currently operating with Cebu Pacific. At present, Planespotters.net reports the carrier’s narrowbody fleet at 39 Airbus A320 and 22 Airbus A321 jets. In that case, over 70 percent of the fleet is the A320 family, making it the airline’s main workhorse.

A similar or slightly skewed distribution of pilots can also be estimated. This means that most of Cebu Pacific’s pilots, including those on the widebody A330neo fleet, are trained and proficient on the Airbus, are trained and proficient on the Airbus.

Therefore, a seismic shift to the 737 MAX will require Cebu Pacific to invest heavily in retraining pilots to be certified on the MAX over the following years. There’s also the question of the readiness of the Philippine aviation industry to supply 737-certified pilots, given the Philippines is a major Airbus country.

Not only are pilots in need of retraining, cabin crew and ramp personnel will also need to undergo familiarization with the new aircraft. The two aircraft have so many unique operating characteristics that one may not easily carry over to the other.

Conclusion

Cebu Pacific’s decision to choose Airbus for its historic fleet expansion reflects a strategic focus on leveraging its expertise, maximizing efficiency, and ensuring fleet compatibility. There are so many other reasons that may not have been presented and discussed above that compelled the low-cost carrier to choose European.

While Boeing remains a strong contender, Airbus appears to be a better fit for Cebu Pacific’s current needs and vision. However, the future remains open – a compelling new offering from Boeing could always entice the carrier in the years to come.

Do you think Cebu Pacific made the right call? We’d love to hear your thoughts in our comments section below.

Leave a comment